Unlocking Financial Alternatives: Peer-to-Peer Personal Loans For Bad …

페이지 정보

본문

In as we speak's financial panorama, securing a personal loan generally is a daunting task, particularly for people with unhealthy credit. Traditional lending establishments usually impose stringent necessities, leaving many borrowers feeling trapped and with out choices. Nonetheless, the rise of peer-to-peer (P2P) lending platforms has opened new doors for those seeking monetary assistance, providing a viable solution for individuals with less-than-excellent credit histories.

Peer-to-peer lending is a revolutionary idea that connects borrowers straight with particular person investors, bypassing traditional banks and financial institutions. This revolutionary approach not solely streamlines the lending process but in addition provides a possibility for borrowers with unhealthy credit score to entry funds which may in any other case be unavailable to them. As P2P lending continues to gain traction, it is crucial to understand how it really works, the advantages it gives, and the potential risks concerned.

Understanding Peer-to-Peer Lending

At its core, peer-to-peer lending facilitates the direct exchange of funds between people. Borrowers create profiles on P2P platforms, detailing their monetary wants, credit historical past, and the aim of the loan. Traders, however, can browse these profiles and choose which borrowers they wish to fund based mostly on their danger appetite and funding targets.

Considered one of the important thing benefits of P2P lending is its flexibility. In contrast to conventional lenders, P2P platforms typically consider extra than just credit score scores when evaluating loan applications. Factors akin to earnings, employment historical past, and overall financial behavior can play an important function in determining eligibility. This inclusive strategy permits borrowers with bad credit score to present their case and potentially secure funding.

The advantages of P2P Lending for Unhealthy Credit score Borrowers

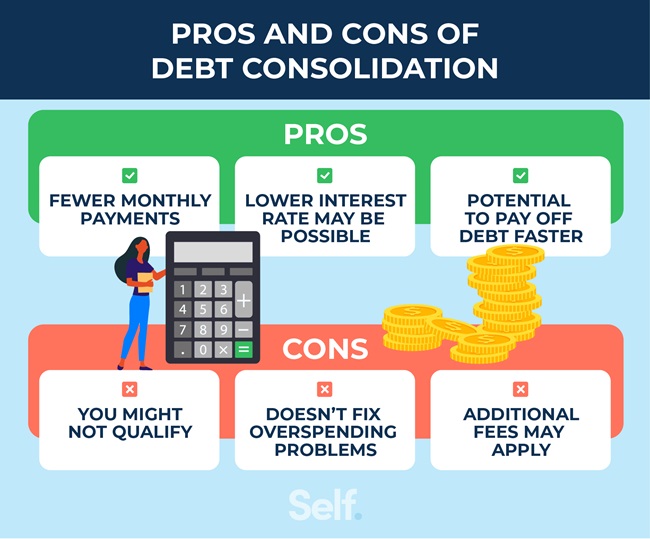

- Access to Funds: For individuals with bad credit score, accessing conventional loans might be almost unattainable. P2P lending platforms offer an alternative route, enabling borrowers to acquire personal loans for numerous functions, together with debt consolidation, medical bills, or personal loans for people with bad credit history home enhancements.

- Lower Interest Rates: While curiosity rates for unhealthy credit score borrowers are typically larger than those for prime borrowers, P2P lending can nonetheless offer extra competitive rates compared to payday loans or credit cards. Investors on P2P platforms are often keen to take on extra danger in trade for probably higher returns, which can translate to lower rates for borrowers.

- Quick Approval Process: The P2P lending process is usually faster than traditional lending. Once a borrower submits their utility, it could take just a few days to obtain funding, making it an attractive possibility for these in pressing need of money.

- Transparency: P2P platforms present clear information regarding fees, interest charges, and repayment phrases. Borrowers can easily evaluate offers from completely different traders, allowing them to make informed choices that go well with their financial situations.

- Building Credit: Efficiently repaying a P2P loan can help borrowers improve their credit score scores over time. This will open up further financial opportunities in the future, enabling borrowers to entry better charges and phrases.

The Dangers of P2P Lending

While P2P lending presents quite a few advantages, it's not with out its dangers. Borrowers should bear in mind of the next potential pitfalls:

- Higher Interest Rates: Although P2P loans can be more inexpensive than some alternatives, borrowers with bad credit should face larger curiosity charges than these with good credit score. It is crucial to buy round and examine gives earlier than committing to a loan.

- Potential for Scams: As with any on-line financial transaction, there's a risk of fraud. Borrowers ought to thoroughly research P2P platforms and ensure they are legitimate and respected earlier than sharing personal data or accepting funds.

- Variable Phrases: Interest rates and terms can vary significantly between different buyers on P2P platforms. Borrowers could have to be flexible and negotiate phrases that work for both events.

- Impression on Credit score Score: Whereas timely repayments can improve credit scores, missed funds can have the other impact, additional damaging a borrower's credit score profile. If you loved this article and also you would like to collect more info relating to personal loans for people with bad credit history (Learn Additional Here) i implore you to visit the web site. It is important for borrowers to evaluate their means to repay earlier than taking on additional debt.

Learn how to Get Began with P2P Lending

For those considering peer-to-peer lending as an answer for unhealthy credit score, the next steps may also help information the process:

- Research Platforms: Start by researching varied P2P lending platforms. Look for those that specifically cater to borrowers with bad credit and have a powerful observe file of successful loans.

- Create a Profile: When you select a platform, create an in depth profile that outlines your financial scenario, loan objective, and repayment plan. Being clear and trustworthy will help construct trust with potential buyers.

- Set a practical Loan Quantity: Decide how a lot money you want and be sure that the quantity is reasonable primarily based in your monetary circumstances. Borrowing greater than necessary can result in difficulties in repayment.

- Evaluate Gives: After submitting your software, overview the provides you obtain from investors. Take the time to compare interest charges, fees, and repayment terms earlier than making a choice.

- Plan for Repayment: Before accepting a loan, create a funds that features your monthly funds. Guarantee which you can comfortably manage the repayments alongside your different monetary obligations.

Conclusion

Peer-to-peer lending has emerged as a robust software for individuals with dangerous credit looking for personal loans. By connecting borrowers directly with buyers, P2P platforms offer a extra inclusive and versatile approach to lending. Whereas there are risks concerned, the potential benefits—such as improved access to funds, lower interest charges, and the chance to construct credit—make P2P lending a beautiful option for many.

Because the financial panorama continues to evolve, it is important for borrowers to stay knowledgeable and explore all out there choices. With careful research and planning, peer-to-peer lending can unlock monetary opportunities and pave the best way for a brighter financial future for those with bad credit.

- 이전글Expert Psychiatric Care in Chennai – Anxiety, Depression, Bipolar & More 25.08.08

- 다음글The Reasons Best Robot Vacuum Cleaner Is More Difficult Than You Imagine 25.08.08

댓글목록

등록된 댓글이 없습니다.