How Do You Define Gold ETFs? Because This Definition Is Fairly Exhaust…

페이지 정보

본문

Some jewellery shops might provide small gold bars for buy, though buying jewellery as an investment is just not really useful as a result of gold jewellery prices reflect more than simply the value of the steel. The gold content material in jewellery is lower as a result of it’s blended with other metals to make it sturdy enough to wear. The most important good thing about gold ETFs and mutual funds is their comfort: It’s simple to purchase and sell them with an atypical brokerage account, and you'll usually buy them by a retirement account. Investing in gold mutual funds and ETFs is similar to investing in other mutual funds and ETFs that mirror an index or are composed of a bunch of stocks operating in a market sector like energy. If you buy into a fund that holds stocks of gold companies, you might get some diversification as a result of you’re holding a basket of stocks as a substitute of just one.

Some jewellery shops might provide small gold bars for buy, though buying jewellery as an investment is just not really useful as a result of gold jewellery prices reflect more than simply the value of the steel. The gold content material in jewellery is lower as a result of it’s blended with other metals to make it sturdy enough to wear. The most important good thing about gold ETFs and mutual funds is their comfort: It’s simple to purchase and sell them with an atypical brokerage account, and you'll usually buy them by a retirement account. Investing in gold mutual funds and ETFs is similar to investing in other mutual funds and ETFs that mirror an index or are composed of a bunch of stocks operating in a market sector like energy. If you buy into a fund that holds stocks of gold companies, you might get some diversification as a result of you’re holding a basket of stocks as a substitute of just one.

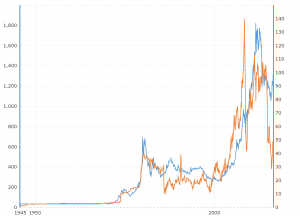

The following guide on gold costs will assist you perceive fluctuations in value, why you may even see different prices, and every little thing else it is advisable to know to make an knowledgeable choice. Diversification: Because gold is usually not extremely correlated to different belongings, it may help diversify portfolios, meaning the general portfolio is much less unstable. Once grasped, these primary principles will make it easier to have a look at each house with a better understanding of what is required to create the right setting every time. Search for low expense ratios - the payment you pay for fund administration, advertising and administration - when you consider the holdings and performances. Be cautious that some gold IRA companies use scare tactics in their marketing to use fears of a catastrophic and unprecedented meltdown of the U.S. Our purpose is usury, for to carry somebody into embarrassment in order to take advantage of his embarrassment, is to apply usury. Gold bullion - gold bars, ingots, rounds and coins - is a common solution to invest in bodily gold. One of the simplest ways to buy gold as an investment relies upon in your private funds and goals.

The following guide on gold costs will assist you perceive fluctuations in value, why you may even see different prices, and every little thing else it is advisable to know to make an knowledgeable choice. Diversification: Because gold is usually not extremely correlated to different belongings, it may help diversify portfolios, meaning the general portfolio is much less unstable. Once grasped, these primary principles will make it easier to have a look at each house with a better understanding of what is required to create the right setting every time. Search for low expense ratios - the payment you pay for fund administration, advertising and administration - when you consider the holdings and performances. Be cautious that some gold IRA companies use scare tactics in their marketing to use fears of a catastrophic and unprecedented meltdown of the U.S. Our purpose is usury, for to carry somebody into embarrassment in order to take advantage of his embarrassment, is to apply usury. Gold bullion - gold bars, ingots, rounds and coins - is a common solution to invest in bodily gold. One of the simplest ways to buy gold as an investment relies upon in your private funds and goals.

Gold alternate-traded funds (ETFs) and mutual funds is perhaps the easiest method for anyone who already has a retirement or brokerage account to invest in gold. You should buy shares of gold ETFs and mutual funds by means of major brokerage firms and buying and selling apps that assist you to reap the benefits of analysis instruments, track funds' historic performances and gain access to academic sources so you'll be able to research your choices before shopping for. For novice investors, shopping for gold bars or coins could be appealing since you may see and touch your investments, versus other assets like stocks and bonds. Gold coins are minted by a government mint; they've a face worth - though the precise value of the metal is more likely to be far greater. Bullion - particularly smaller bars - is simpler to promote rapidly than coins, especially uncommon coins. Investment-grade gold has 99.5% (995) purity and the price of bullion correlates to the value of the steel itself. When you select to have your steel shipped to you, you could must cowl transportation costs, and you’d must retailer it safely, plus pay for insurance. The Commodities Futures Trading Commission's (CFTC) article on these seemingly omnipresent gross sales pitches does not go subtle with its title: "Gold Is not any Safe Investment." Like the Federal Trade Commission and different regulators, the CFTC has seen a major rise in gold-associated frauds and cons, often led by dubious claims about gold at all times being a threat-free store of worth.

Remember the fact that bodily gold will be bulky, so you have to consider the cost of storing it in a safe place - which implies either investing in a safe or renting a bank security deposit field - as well as insuring it. This study reevaluates the standard position of gold as a common protected haven throughout periods of stock market distress. In case you plan to rely in your investments for retirement earnings, holding physical gold might put you able of getting to just accept a lower price if you happen to need cash rapidly. In other words, instead of placing all of your cash in stocks, put some in stocks, some in bonds, and a few in different investments like hedge funds, non-public fairness, and even wonderful artwork and wine. Beginners purchase gold with hesitation, however typically put in quite a lot of analysis before making their transfer. You don’t have to speculate so much to get started due to the ubiquity of online buying and selling apps that provide fee-free trading and fractional shares, which let you put money into "slices" of shares typically for as little as $1. The Baht weight should not be confused with Thailand’s nationwide forex, the ‘Baht’, though like loads of paper currencies, the title ‘Baht’ (the Thai paper forex) is derived from the historic precious metals weight measurement, the ‘Baht’.

If you have any type of inquiries regarding where and exactly how to use سعر الذهب في المانيا, you could call us at our own web site.

- 이전글Casino Plex Review 24.12.05

- 다음글You'll Never Guess This Bmw Spare Key Cost's Tricks 24.12.05

댓글목록

등록된 댓글이 없습니다.